Car depreciation calculator tax deduction

You have a very affordable and reliable vehicle the Toyota 4runner. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

Macrs Depreciation Calculator With Formula Nerd Counter

27000 business kilometres 30000 total kilometres x 7000 6300.

. This means in the second year you claim 25 of 7500 which is 1875 in depreciation. All you need to do is. Consult your tax professional.

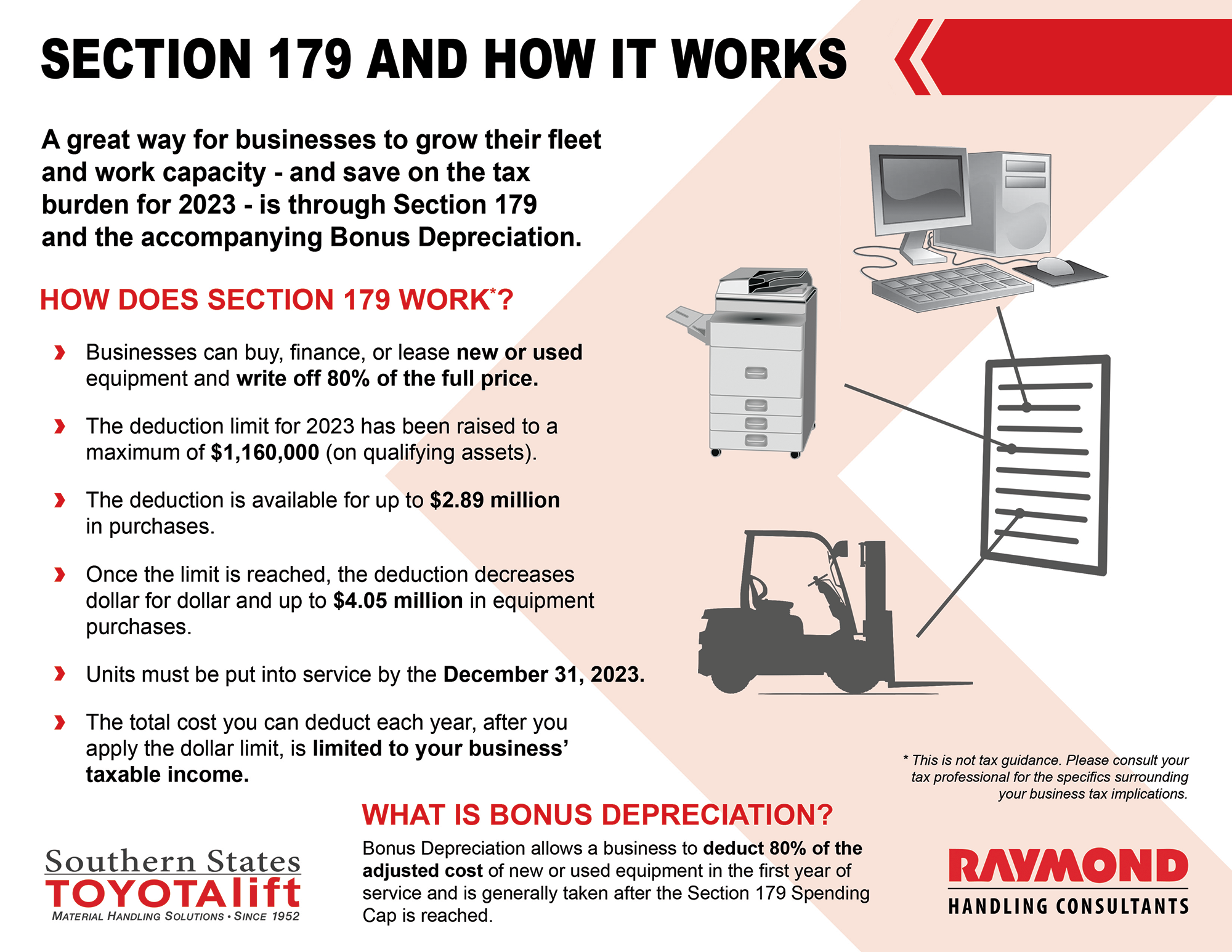

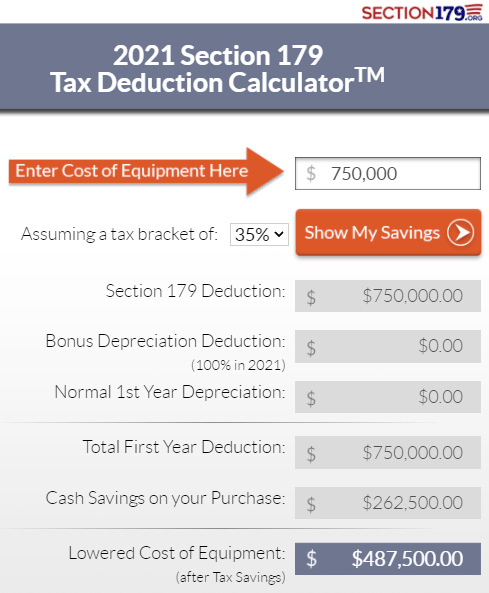

Heres an easy to use calculator that will help you estimate your tax savings. The calculator also estimates the first year and the total vehicle depreciation. There is a dollar-for-dollar phase out for.

You must not have claimed a depreciation deduction for the car using any method other than straight-line. It is included here so that when you print a schedule it will include the identity of the asset. You can generally figure the amount of your deductible car expense by using one of two methods.

Calculate your deduction for other vehicles Work out your deduction for the expenses you incur when you use. Cars for income tax purposes are defined as motor vehicles including four-wheel drives designed to carry both. Simply enter in the purchase price of your equipment andor software and let the calculator take care of the rest.

You cant have claimed a Section 179 deduction or the special depreciation allowance on the car. The motor vehicle must be owned leased or under a hire-purchase agreement. Someone elses car Vehicles which are not cars Someone elses car If you use someone elses car you can claim a deduction for actual costs you.

The calculator makes this calculation of course Asset Being Depreciated - This has no impact on the calculation. The 2022 standard mileage rate is 585 cents per mile and for 2021 is 56 cents per mile for business. Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items.

Cost x Days held 365 x 100 Effective life in years Note also that where motor vehicles are concerned luxury cars have an upper depreciation limit. You cant have claimed actual expenses on a leased car after 1997. If you operate your business as a company or trust you can also claim for motor.

Total expenses for the truck 7000. Prime Cost Depreciation Method The Prime Cost method allocates the costs evenly over the years of ownership. Please note that this Section 179 Calculator fully reflects the current Section 179 limits and any and all amendments bonus depreciation.

Our Car Depreciation Calculatorbelow will allow you to see the expected resale value of over 300 modelsfor the next decade. It can be used for the 201314 to 202122 income years. Eligible vehicles include cars station wagons and sport utility vehicles.

Fewer than nine passengers. Its GVWR is between 6100 to 6300 lbs which means it. 18100 First-Year Depreciation for Qualifying Models In 2021 and under IRC 168 k your business may have qualified for a federal income tax deduction up to 18100 of the purchase price of Nissan models that dont qualify for the 100 depreciation deduction when purchased and placed in service in 2021.

Discover Helpful Information And Resources On Taxes From AARP. Alternatively if you use the actual cost method you may take deductions for depreciation lease payments registration fees licenses gas insurance oil repairs garage rent tolls tires and parking fees. You cant use any method besides straight line to claim a depreciation deduction for the car.

If you enter 100000 for basis and business use is 80 then the basis for depreciation adjusted basis is 80000. Select the currency from the drop-down list optional Enter the purchase price of the vehicle. If you qualify to use both methods you may want to figure your deduction both ways before choosing a method to see which one gives you a larger deduction.

In order to take any form of business deduction for your car youll have to calculate your percentage of business use. The next year you calculate depreciation as 25 of that written-down value not the original 10000 purchase price. Qualifying businesses may deduct a significant portion up to 1080000 in 2022 to be adjusted for inflation in future years.

We have also built historical depreciation curves for over 200 models many of which go back as far as 12 years. Nine passengers or more such as a minivan. We will even custom tailor the results based upon just a few of your inputs.

Audi Q7 BMW X5 X6. Interest on loan to buy truck 1900. If accelerated this car can give you a tax deduction of 92000 in the first year.

This Car Depreciation Calculator allows you to estimate how much your car will be worth after a number of years. Not bad at all. Heres a partial list of SUVs and Trucks that might qualify for a tax deduction in 2022.

It is fairly simple to use. This calculator helps you to calculate the deduction you can claim for work-related car expenses for eligible vehicles. Licence and registration fees 100.

Murray calculates the expenses he can deduct for his truck for the tax year as follows. Subtracting that 1875 from 7500 gives your cars new written-down value of 5625 so in year 3 your depreciation will be 25 of. The standard mileage rate method or the actual expense method.

Section 179 Deduction Hondru Ford Of Manheim

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Business Tax Deductions Small Business Tax Deductions Tax Deductions

Free Macrs Depreciation Calculator For Excel

1

Macrs

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Real Estate Lead Tracking Spreadsheet Tax Deductions Free Business Card Templates Music Business Cards

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Using The Section 179 Tax Deduction For New Forklift Purchases In 2021

Ay 2022 23 Depreciation Rate Chart As Per Income Tax Act 1961 Income Tax Taxact Tax

The Current State Of The Section 179 Tax Deduction

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Difference Between Tax Depreciation And Book Depreciation Difference Between

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

1

.png)

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker